Table of Content

Banks offer premature withdrawal facility to their customers but often with a penalty. This FD feature is helpful for people who require emergency cash for things like medical emergencies, financial problems brought on by losing their jobs, debt repayment, and other things. This could be a certain percentage of the outstanding loan amount. Now, if a borrower approaches his bank to get his existing loan linked to the new lending benchmark, the banks would process such a request, only after levying a cost for the same. The original sale document is submitted to the bank by the borrower, after the deed is registered at the sub-registrar’s office. This document is then sent by the bank branch to a central location, where it is kept safe through the course of the loan tenure.

SBI home loans have a consolidated processing fee which is 0.40% of the loan amount plus the applicable GST. The minimum amount is Rs.10,000 plus GST while the maximum amount is Rs.30,000 plus GST. Before taking a home loan from SBI, it’d be a good idea to check whether you will be able to pay the monthly instalments. The easiest way to do this is to use Home Loan Calculator. Just enter the proposed loan amount, the tenure of the loan, the interest rate the bank is offering you, and the processing fee.

SBI ने ग्राहकों को दिया तोहफा, FD की ब्याज दरों में कर दी इतनी बढ़ोतरी

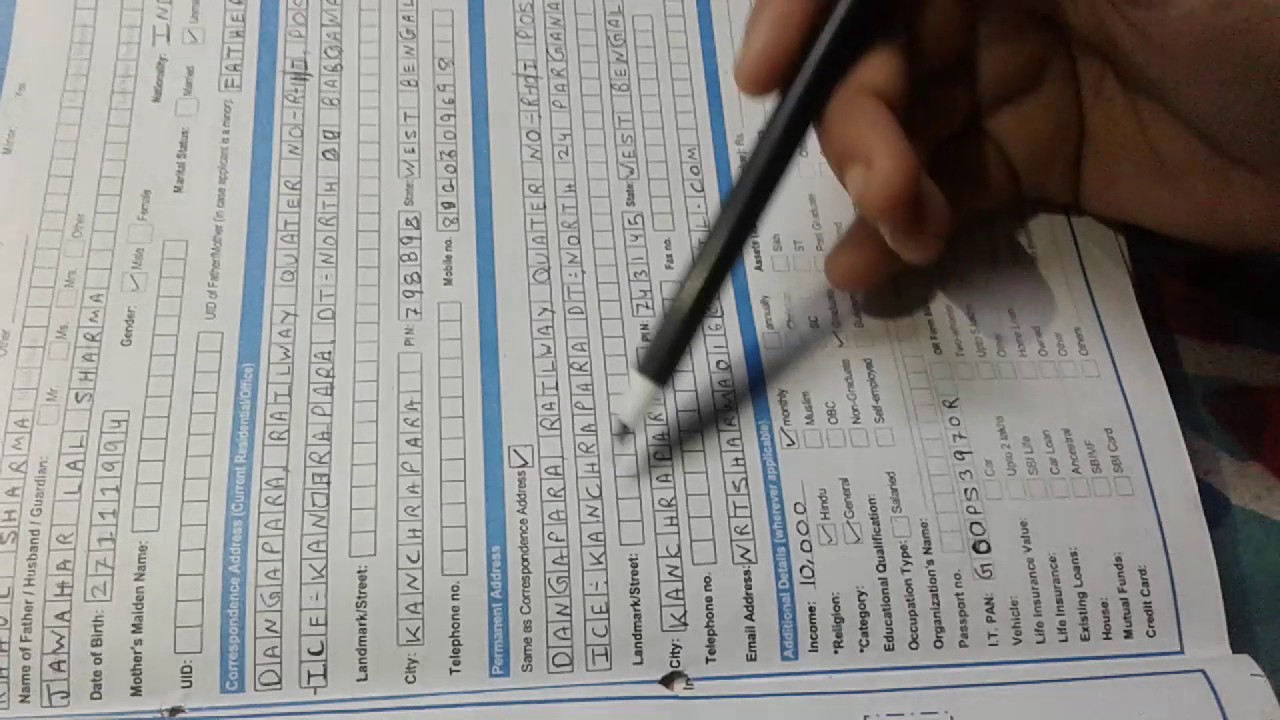

You need to meet the following eligibility criteria to apply for SBI NRI home loan. Central Registry of Securitisation Asset Reconstruction and Security Interest registration fee of Rs. 50 + GST on an amount up to Rs. 5 lakh and Rs. 100 + GST for limits above Rs. 5 lakh will be charged. The loan amount is determined by repaying capacity and the value of property to be financed.

Where mortgage can't be provided, other tangible security would need to be provided. The title of the property should be clear, for which a certificate would be required from the Bank's approved advocate, safeguarding your interests as well as Bank's interests. On an average, loans are disbursed within 3-10 days after satisfactory and complete documentation and completion of all the required procedures. Longer the tenure you have, the lesser will be your EMI but higher would be the interest outgo. In shorter tenures, you pay a greater EMI, but the loan gets repaid faster and you pay less by way of interest. As home loans involve a large sum of money, the tenure generally varies between 3 to 30 years.

Latest in Tax

This scheme is available for applicants that are aged from 18 years to 70 years of age. If, at some point in your loan tenure, you realise that another lender is offering you better services at lower interest rates, you may be tempted to move your home loan to the new bank. However, the new bank will first look at your repayment record before approving your home loan transfer request. In case you do not have any documentary proof of the same, you have to approach your home branch to get a copy.

SBI raised the interest rate on tenure of one year to less than two year to 6.75 percent from 6.10 percent which is 65 basis points. Indian refiners may be able to source most of their Russian oil purchases at a rate lower than the West’s price cap of $60 after international prices fell. 1) How the bank determines the amount refunded by calculating interest on the FD. The bank has alleged that the companies availed credit facilities from the State Bank of India and misappropriated them by diverting them for other use rather than for the purpose they were sanctioned for. This is a type of home loan that is sanctioned even before the property has been finalized.

SBI Home Loan Interest Rate

It is generally advantageous to go for a home loan as it helps you in availing tax benefits. However, please consult your CA or tax advisor to discuss the pros and cons. Yes, your salaries can be clubbed for the purpose of calculation of the loan amount. This can be done either when the property is jointly held with the spouse or the spouse stands as a guarantor. Thus, we ensure a great deal of flexibility in the entire exercise of financing your house. There are two types of power of attorney.First, the 'General Power of Attorney' where a property owner confers 'general' rights.

You will have to contact the bank to know the interest rates that the bank would offer. This is an exclusive scheme for individuals who have an income but will not earn a monthly salary. It has special offers on loans to buy new residential units, construct houses, repair, renovate, and transfer a loan from one bank to another bank. This scheme is open to proprietors, directors of companies, and partners too. The loan amount in this particular scheme is from Rs. 50,000 to Rs. 50 crores.

The former is charged before sanctioning the loan and the latter is charged after sanctioning the loan. However, it would be naïve on the part of the borrower, to simply opt for the bank that offers the lowest rate of interest on home loans. The overall cost of borrowing a huge sum of money increases significantly through the various hidden charges and a smart borrower should ensure that he is not caught unawares by the bank on this front. State Bank of India has come up with SBI NRI home loan schemes, specially designed to help NRIs buy a house in India. SBI NRI housing loan comes with long repayment tenure, attractive interest rates, and a hassle-free documentation process.

The SBI home loan interest rate today will be based on the CIBIL score of the applicant. There is a choice to repay the interest component during the pre-EMI period of the loan. Younger professionals will have a 20% improvement in home loan eligibility. This scheme is launched for the people who live in tribal or hilly areas. The repayment tenure for this particular loan is a period of 15 years. There is no land mortgage required, and a third-party guarantor is allowed.

A Power of Attorney allows a person to grant another person the right to make decisions regarding the person's assets, finances and real estate properties. SBI welcomes you to explore the world of premier banking in India. Our commitment to nation-building is complete & comprehensive. SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of SBI. Does SBI home loan take the salary of the spouse into consideration?

This is the third time the MCLR rates have been increased.The bank also increased its RLLR and EBLR by 50 basis points to 7.65%. Pradhan Mantri Awas Yojana can help you save money on your first house. Under the scheme, you can get subsidy of up to Rs.2.67 lakh. The subsidy is available to individuals earning up to Rs.18 lakh per year.

Also, women should be a co-owner or sole owner of the property for which the loan is being availed. You are just one step away from using Home Loan related services. This consent will override any registration for DND/NDNC/NCPR. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans. Please get answers to your common queries regarding the home loan, security, EMIs, etc. Explore your dream house from a bouquet of exclusive products designed for each customer segment.

No comments:

Post a Comment